About

Elektrik is the premier decentralized exchange on the LightLink network. The protocol is underpinned by gasless transactions and the ELTK token economy. This not only enhances the trading experience, it also incentivizes governance participation and increases yield for protocol participants.

Zero Gas Fees

Optimized trading environment to reduce trade costs and improve the on-chain trading experience

ELTK Token Economy

Boosted yield opportunities for governance participants and liquidity providers

Pro trading experience

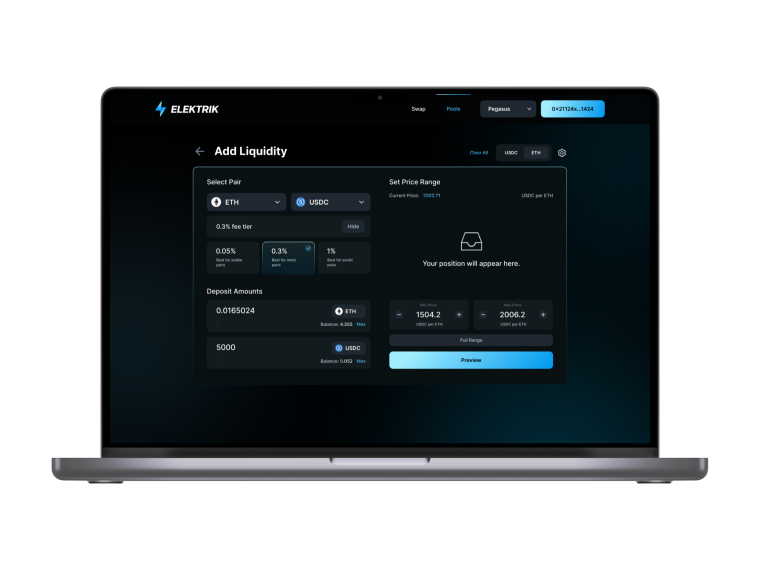

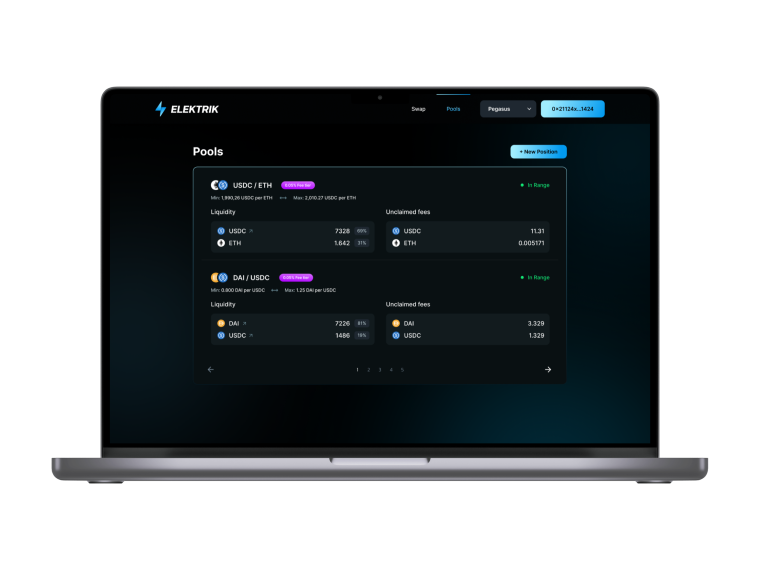

Offers advanced on-chain trading tools to elevate the DEX experience

SWAP

Liquidity Provision

Governance

About

Elektrik is the premier decentralized exchange on the LightLink network. The protocol is underpinned by gasless transactions and the ELTK token economy. This not only enhances the trading experience, it also incentivizes governance participation and increases yield for protocol participants.

Zero Gas Fees

Optimized trading environment to reduce trade costs and improve the on-chain trading experience

ELTK Token Economy

Boosted yield opportunities for governance participants and liquidity providers

Pro trading experience

Offers advanced on-chain trading tools to elevate the DEX experience

$ELTK TOKENOMICS

Elektrik's vote-escrow token economy rewards long-term token lockers, promoting stability and reducing trade slippage by enhancing liquidity pool stickiness. This, along with a focus on liquidity stickiness and fair fee distribution, aligns incentives to create a positive flywheel, benefiting the overall LightLink ecosystem.

Liquidity is used to

make a market, earning

fees and improving the

trading environment

veELTK holders receive

yield based on the trading

volume of

the pool they

voted for and rebase

amounts

ELTK emissions attract liquidity and LP token locking

Higher ELTK emissions leads to

more liquidity and a greater

trading experience, resulting in

more trader fees paid to

liquidity providers

$ELTK TOKENOMICS

Elektrik's vote-escrow token economy rewards long-term token lockers, promoting stability and reducing trade slippage by enhancing liquidity pool stickiness. This, along with a focus on liquidity stickiness and fair fee distribution, aligns incentives to create a positive flywheel, benefiting the overall LightLink ecosystem.

Liquidity is used to make a market, earning fees and improving the trading environment

ELTK emissions attract liquidity and LP token locking

Higher ELTK emissions leads to more liquidity and a greater trading experience, resulting in more trader fees paid to liquidity providers

veELTK holders receive yield based on the trading volume of the pool they voted for and rebase amounts

OUR MISSION

To power superior on-chain trading, with access to

professional

level tools and a unique, flexible approach to liquidity provision.

Our mission is to build a capital-efficient decentralized exchange that supercharges on-chain trading.

Leveraging the power of the LightLink’s gasless environment, we strive to provide an unrivaled trading and liquidity provision experience.

OUR MISSION

To power superior on-chain trading, with access to

professional

level tools and a unique, flexible approach to liquidity provision.

Our mission is to build a capital-efficient decentralized exchange that supercharges on-chain trading. Leveraging the power of the LightLink’s gasless environment, we strive to provide an unrivaled trading and liquidity provision experience.

ROADMAP

Q4 2024

Elektrik V2

- Integrate points system

- Broadening intents infrastructure

- Elektrik airdrop phase 3

Q3 2024

Elektrik V1

- Launch Elektrik V2 mainnet

- Work with LightLink foundation and

enterprises for pool bribery purposes - Start phase 2 of ELTK airdrop

2025

MAINNET & AIRDROP

- Various trading intents

- Third party incentives

- Active liquidity management

- Further decentralize the Elektrik Foundation

- Elektrik airdrop phase 4

- Integrate cross-chain liquidity

ROADMAP

Q3 2024

Elektrik V1

- Launch Elektrik V2 mainnet

- Work with LightLink foundation and

enterprises for pool bribery purposes - Start phase 2 of ELTK airdrop

Q4 2024

ELEKTRIK V2

- Integrate points system

- Broadening intents infrastructure

- Elektrik airdrop phase 3

2025

MAINNET & AIRDROP

- Various trading intents

- Third party incentives

- Active liquidity management

- Further decentralize the Elektrik Foundation

- Elektrik airdrop phase 4

- Integrate cross-chain liquidity

Please read the disclaimer carefully before accessing the Elektrik Whitepaper. By clicking ' I Confirm', you acknowledge that you have read and understood the disclaimer.